Student loan boycotts can't stand! Here's how we make them pay up

Student Loan Boycotts Can’t Stand. Here’s How We Make Them Pay Up

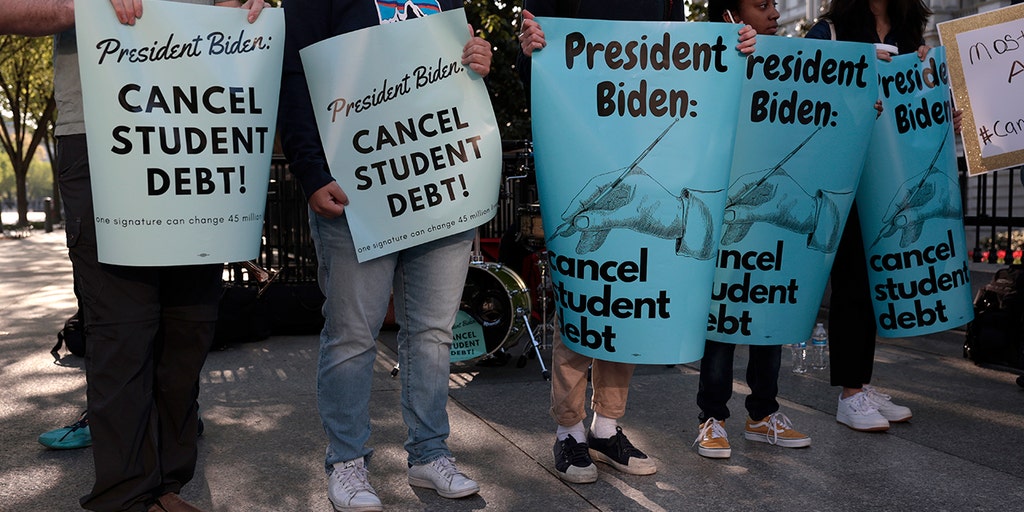

This article discusses the current trend of student loan borrowers in the United States who are boycotting their loan repayments in an attempt to pressure the government into cancelling their debt. The author argues that this boycott marks a disturbing decline in personal responsibility and highlights the importance of understanding the fundamentals of loans and the consequences of failing to repay them. The article also raises concerns about the potential ripple effects of mass loan forgiveness, including widespread boycotts of other types of debt such as credit cards, auto loans, mortgages, and business loans.

What’s Going On Here?

The article addresses the growing trend of student loan borrowers in the U.S. who are refusing to make payments towards their debt as a form of protest. These borrowers are demanding that the government cancel $10,000 of debt per individual. The author expresses concern about this boycott, seeing it as a decline in personal responsibility and a departure from the ethos of working diligently and saving for desired items. The article also draws a comparison to the layaway plan from the 1930s and highlights the importance of understanding the basics of loans.

What Does This Mean?

This trend of student loan boycotts raises questions about personal responsibility and the potential consequences of mass debt cancellation. The article argues that if the federal government yields to the pressure and forgives billions of dollars in student loan debt, it could set a precedent for other forms of debt to be boycotted as well. The author suggests that this could lead to widespread boycotts of credit card payments, auto loans, mortgages, and business loan payments. The article emphasizes the importance of understanding the fundamentals of loans and the need to take responsibility for repaying them.

Why Should I Care?

Understanding the implications of the student loan boycott trend is important for individuals who have diligently saved and paid for their own or their children’s college education. The article highlights the fundamentals of loans, including acquiring a loan, anticipating an interest rate, assuming responsibility for repayment, and facing personal repercussions for neglecting repayment. By boycotting repayments, these borrowers are attributing their failure to fulfill their financial obligations to external factors. This article encourages readers to consider the potential ripple effects of mass loan forgiveness and the importance of personal responsibility in financial matters.

(Note: The article contains links to additional information and sources that may provide further context and details on the topic)

For more information, check out the original article here.